Introducing Club 52 – The Essence of 52 Life-Changing Books

Introducing Club 52 – The Essence of 52 Life-Changing Books Are you a purpose-driven entrepreneur or a family seeking to elevate your life and legacy? Welcome to Club 52, where the essence of 52 transformative books awaits you!

Ethical Finance Awards 2022

And the Winner is….

When we were invited to participate in the Ethical Finance Awards 2022 by Wealth & Finance International we thought it was meant as a joke but then we considered things more seriously. We asked ourselves if we were really sustainable enough to be award material. To be honest, we could not really answer the question. We decided to put our foot forward always and here we are….

Announcing Winner of Ethical Finance Award 2022

Joining All The Dots For Your Successful Philanthropy / Podcast Episode

What is philanthropy to you? Annie Moon joined Sascha Janzen on episode 20 of The True Wealth Project to discuss just that. Annie always wanted to be in the impact space from a young age, she now has over 30 years of experience in many different roles. The passion came to her when she wanted to help others and wanted to do more.

So, what is philanthropy for Annie? Read more

New Podcast Episode Alert: Creating True Wealth and How Financial Planning Can Help Your Intentional Legacy with Vicki Wusche

Vicki Wusche, our guest for episode 14, has her own take on what constitutes wealth – Do you, too, want to live the way you want? What would you do if you never had to work another day in your life?

Read more

New Podcast Episode Alert: How to be financially resilient in times of crisis

ave you got all your eggs in one basket?

Have you charged your money battery?

Are you in financial panic mode or do you look at a 10-years plus horizon?

Find out about Robert Gardner’s Top 10 Tips on how to manage your finances in times of crisis.

The COVID-19 Crisis – What are the Implications for Family Wealth?

Preliminary Observations & Opinions

by Sascha Janzen

as per 28/04/2020

Like most people, I am closely following the news and debates about the ongoing COVID-19 crisis and the respective responses by governments across the world.

As a family business responsible for preparing investment advice and decisions, we keep asking ourselves what the ongoing COVID-19 crisis means for us and our investors. We are firmly grounded in property investment but are asking ourselves if and how we should re-allocate or diversify to be more robust in times of crisis. We are looking beyond the current challenges to position ourselves for the next phase of the crisis. Read more

Opportunity Flash: German Midcap Regional Property Investments

Given the rise in property prices across all use classes and regions in Germany and in particular the steep increase in prices in the major cities, our clients who want to invest in Germany increasingly ask the question how they can still find property investments with decent returns.

Without hard data evidence, we are still seeing good initial yields (>6% gross initial) and assets with upside potential in many regional markets in Germany. Read more

Do You Really Have to be Bent to Become Wealthy?

I recently attended a training course about M&A strategies. It was a good course and a good bunch of interesting people came together. In one of the coffee breaks the conversation drifted towards what is required to be financially successful as an entrepreneur. Read more

How To: Germany for Property Investors

Federal Structure

When talking to international investors of all sorts, one point of misconception has been coming up for decades.

Over the years, different waves of international investors have discovered Germany as an attractive property investment location. Although many follow similar strategies, the approaches have varied. However, one common misconception keeps acting to their disadvantage. Read more

The Magic Moment We Became a Family Business

Following on from my previous post about how to define a family business, I remembered the moment when we became a family business.

Of course, bearing in mind my comments about the difficulty in finding a common definition of the term, the moment we “became” a family business was more in our minds than following a specific event that put our business within such a definition. Read more

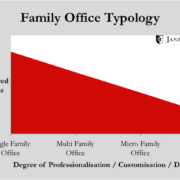

Family Office Typology

In my day-to-day business the term “family office” is frequently used but when the conversation goes a little deeper I regularly find that my counterparts have little or no understanding as to what it actually means. Apart from the notion that all family offices are ultra conservative investors and shy away from any risk (and opportunity), the only other common denominator is the involvement of a family.

So, what actually is a family office and are they all the same or, if not, how are they different? Read more

8 Key Steps To Your Family Social Responsibility Programme

This post was inspired by a blog post I read on corporate social responsibility for small businesses. The article is based on the premise that most small businesses do not have a formal social responsibility programme and that there is a perception that it is quite cumbersome and tedious to set one up. Read more

Who Are My Family Members?

One of the questions that comes to mind when setting up family governance structures is whom to include in such a structure. In other words: who are the members to be governed? Read more

What Even is a Family Business?

What Even is a Family Business? Although often talked about and mentioned, little thought is given to what a familiy business actually is.

Are you Home Biased in Your Investment Approach?

I recently read an article by Kim Iskyan on Truewealth Publishing that was titled “Investing solely in your home country is like juggling live dynamite”. The article is geared towards publicly traded investments but got me thinking about its applicability towards property investment.

Home Staging for Investment Properties

(aka Property Presentation)

While home staging is a well established discipline for the sale of homes and houses, it is not so much established for the investment property sector. Read more

Top 5 Mistakes Handing Over Real Estate Assets To The Next Generation

In my experience, spanning over 20 years of working in the property investment industry, I have observed recurring problems in the process of handing over real estate assets to the next generation. The list of the top 5 mistakes identified are as follows: Read more

Top 5 Make Or Break Points For Successful Philanthropy

Without having any claim to completeness, I have found a number of things to be important to the success of philanthropic activities. This list of key points resembles a list that could be drawn up for any business venture and that is one of the key conclusions I have come to: treat your philanthropic activities as you would treat a business venture!

Extended Family Business System

The Four Dimensions to Consider in Family Governance and Succession

Substantial writing has been done about the three dimensions “Family”, “Business” and “Ownership” when setting up a family governance structure.

However, the prevailing Three-Circle Model of the Family Business System as developed at Harvard Business School by Renato Tagiuri and John Davis in the 1970s is not entirely complete. Read more

Just A Little Respect and Dignity

Christmas is that time of the year when people start to think about giving, caring and being nice while at the same time everybody seems to be stressed out in the run-up to Christmas.

This morning, I had a little moment that really moved me. Read more

We Are All Stewards

Continuing on from my last blogpost, I want to expand on the responsibility theme.

As outlined in the previous blogpost, I strongly believe it is crucial to give your wealth a purpose and a meaning, I also touched on the responsibility that comes along with controlling wealth.

This responsibility can best be understood if you look at yourself as a steward who takes care of the wealth on behalf of others, such as future generations. It becomes even more plastic when you look at our responsibility as humankind to take care of the planet we live on. Read more

What Does It All Mean?

Let us assume you have run a successful business for a number of years or have come into an inheritance and enjoy a significant level of wealth at your disposal. You can afford a good lifestyle and have accumulated all the properties, cars, boats and jets that you can possibly enjoy.

If you do not have direct successors in place to take over or you think they are not worthy of your wealth or you think your wealth will spoil them, you may start asking yourself some serious questions. At some point, you are likely to come up against the question that keeps nagging in the back of your mind: “What does it all mean?”.

The True Wealth Project

The True Wealth Project laura-chouette-Hj8eZ_wK1eM-unsplash-2.jpg laura-chouette-Hj8eZ_wK1eM-unsplash.jpg

laura-chouette-Hj8eZ_wK1eM-unsplash-2.jpg laura-chouette-Hj8eZ_wK1eM-unsplash.jpg